Track all markets on TradingView

XAUUSD Trend Analysis with Targets 2025 | Is Gold a Better Investment for 2030?

XAU/USD Price Prediction 2025 – Gold Investment Analysis & Trading Strategy

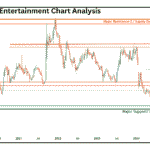

Gold has successfully broken past the previous resistance zone and is now trading above $2,800. This bullish breakout indicates strong buyer control, and historically, such breakouts lead to higher price levels until a major resistance is encountered.

2. Major Support Levels

The chart highlights two key support zones:

- Major Support – 1: Around $2,555

- Major Support – 2: Around $2,075

These levels are crucial because if a price correction occurs, these zones will act as strong demand areas where buyers may step in to push prices higher.

3. Strong Uptrend (Higher Highs & Higher Lows)

Gold continues to maintain a strong bullish trend by forming higher highs and higher lows. This structure remains intact, confirming the buying momentum in the market. Additionally, price action and market structure favor buyers.

4. Possible Retest & Support Zone Validation

After a breakout, prices often retest previous resistance levels, which now act as support. In this case:

- The $2,750 – $2,800 range may act as a new support zone.

- If gold holds this support, the bullish momentum is expected to continue.

- If it falls below this level, a correction towards $2,555 is possible.

Trading Plan for XAUUSD Chart – Gold vs US Doller

1. Buy on Retest

If gold price pulls back to the $2,750 – $2,800 zone and forms bullish confirmation signals (such as bullish engulfing, hammer, or high buying volume), it will be a good buying opportunity.

- Entry: $2,750 – $2,800

- Stop Loss (SL): Below $2,700

- Target 1: $2,900 – $2,950

- Target 2: $3,000+ (All-time high levels)

2. Trend Following Trade

If the price continues rising without a retest, traders should monitor next resistance levels for potential breakout trades.

- Entry: Breakout above $2,900 with strong volume

- SL: Below $2,850

- Target: $3,050 – $3,100

3. Risk Management & Caution

- Fake Breakouts: If the price falls below $2,750 and forms lower lows, the trend may weaken.

- Macroeconomic Factors: Gold is influenced by the US Dollar Index (DXY), Federal Reserve policies, and geopolitical events.

- Volume Confirmation: Strong volume during breakouts and support validations is critical.

Is Gold a Better Investment for 2030?

Gold Is a Better Investment for 2030?

1. Gold: A Safe-Haven Asset

Gold को हमेशा safe-haven asset माना जाता है क्योंकि यह inflation, economic uncertainty, और geopolitical risks के दौरान stable रहता है। जब stock market crash होता है या global economy में मंदी (recession) आती है, तो Gold की कीमतें अक्सर बढ़ जाती हैं।

Gold Investment के फायदे:

Inflation Hedge: जब inflation rate बढ़ता है, तो Gold की कीमतें आमतौर पर बढ़ती हैं, क्योंकि इसकी खरीदारी ज्यादा होती है।

Low Volatility: Stocks की तुलना में Gold कम volatile होता है, जिससे यह एक सुरक्षित निवेश माना जाता है।

Central Bank Demand: दुनियाभर के central banks अपनी reserves में Gold खरीदते हैं, जिससे इसकी demand बनी रहती है।

Currency Depreciation: अगर USD Index (DXY) कमजोर होता है, तो Gold की कीमतें बढ़ने की संभावना होती है।

Conclusion (निष्कर्ष)

- Gold का overall trend अभी bullish है, और price ने एक महत्वपूर्ण breakout किया है। यदि price $2,750 – $2,800 का support hold करता है, तो आगे और upside potential हो सकता है। अगले resistance zones $2,900 और $3,000 हैं, जहाँ price action पर ध्यान देना होगा।

- अगर आप इस चार्ट के आधार पर एक detailed trading strategy चाहते हैं, तो timeframe (intraday, swing, या positional) के हिसाब से विश्लेषण किया जा सकता है।

- “What’s your Gold price prediction for 2025? Comment below!”

- Read On Investopedia – What Drives the Price of Gold?

- XAUUSD analysis on Trading View

Natural Gas(NG) Targets for swing Trading 2025 | Natural Gas के दाम आसमान पर

Nifty Confirm Targets for Intraday option Trading in 2025 | Nifty Trading Helpline

Share market ke andar ki baat | शेयर मार्केट की अंदर की बात जनहित में जारी

यह ब्लॉग हमने उन लोगों की मदद करने के लिए बनाया है जो शेयर बाजार (Stock Market) के बारे में हिंदी में सीखना चाहते हैं और शेयर मार्केट से पैसे कमाना चाहते हैं।